Feature Design

AI Feature Design

AI-Enhanced Goal Setting for Chase Digital Assistant

AI-Enhanced Goal Setting for Chase Digital Assistant

Overview

Overview

In this project, I designed an AI-powered Financial Wellness Coach for Chase’s mobile banking app to revolutionize how users achieve their financial goals. By analyzing spending patterns and predicting future outcomes, the assistant delivers real-time insights, dynamic goal adjustments, and personalized recommendations to empower smarter financial decisions.

In this project, I designed an AI-powered Financial Wellness Coach for Chase’s mobile banking app to revolutionize how users achieve their financial goals. By analyzing spending patterns and predicting future outcomes, the assistant delivers real-time insights, dynamic goal adjustments, and personalized recommendations to empower smarter financial decisions.

Approach

Approach

UX Research

Interaction Design

UX Research

Interaction Design

Figma, Miro

Figma, Miro

Sole Designer

Sole Designer

The Challenge

Despite the wide range of digital financial tools available, users still struggle with:

Despite the wide range of digital financial tools available, users still struggle with:

Connecting daily financial habits with long-term goals.

Connecting daily financial habits with long-term goals.

Accessing real-time, personalized insights that adapt to their behavior. Current tools provide generic feedback, not actionable advice.

Accessing real-time, personalized insights that adapt to their behavior. Current tools provide generic feedback, not actionable advice.

Adjusting financial strategies when income or expenses fluctuate.

Adjusting financial strategies when income or expenses fluctuate.

These limitations lead to disengagement, financial stress, and difficulty achieving meaningful financial progress.

These limitations lead to disengagement, financial stress, and difficulty achieving meaningful financial progress.

Project Goal

The goal was to integrate predictive AI and personalized financial guidance into the Chase mobile app to deliver:

The goal was to integrate predictive AI and personalized financial guidance into the Chase mobile app to deliver:

Real-time financial insights and actionable recommendations tailored to each user.

Real-time financial insights and actionable recommendations tailored to each user.

Dynamic goal adjustments that respond to spending patterns, income changes, or financial behavior.

Dynamic goal adjustments that respond to spending patterns, income changes, or financial behavior.

Proactive nudges and tailored suggestions that encourage smarter financial habits.

Proactive nudges and tailored suggestions that encourage smarter financial habits.

How Might We

How might we design an AI-powered assistant that automatically adjusts financial goals based on real-time behavioral insights and provides proactive recommendations to help users achieve their financial objectives through changing circumstances?

How might we design an AI-powered assistant that automatically adjusts financial goals based on real-time behavioral insights and provides proactive recommendations to help users achieve their financial objectives through changing circumstances?

Research and Insights

Our research included user interviews with 12 users with existing Chase mobile apps, competitive analysis, and behavioral studies that revealed:

Our research included user interviews with 12 users with existing Chase mobile apps, competitive analysis, and behavioral studies that revealed:

Pain Points with Static Goals

Pain Points with Static Goals

Financial tools lacked flexibility. Users couldn’t adjust goals in real time when their situations changed, leading to disengagement and missed opportunities.

Financial tools lacked flexibility. Users couldn’t adjust goals in real time when their situations changed, leading to disengagement and missed opportunities.

Simplicity and Transparency

Simplicity and Transparency

Despite the complexity of financial data, users preferred a clear, intuitive interface that provided them with simple, actionable feedback without overwhelming them with jargon.

Despite the complexity of financial data, users preferred a clear, intuitive interface that provided them with simple, actionable feedback without overwhelming them with jargon.

Desire for Proactive Financial Coaching

Desire for Proactive Financial Coaching

Participants wanted a smart assistant capable of offering dynamic, tailored advice based on their behavior.

Participants wanted a smart assistant capable of offering dynamic, tailored advice based on their behavior.

Pain Points with Current Services

Frustrations with Current Services

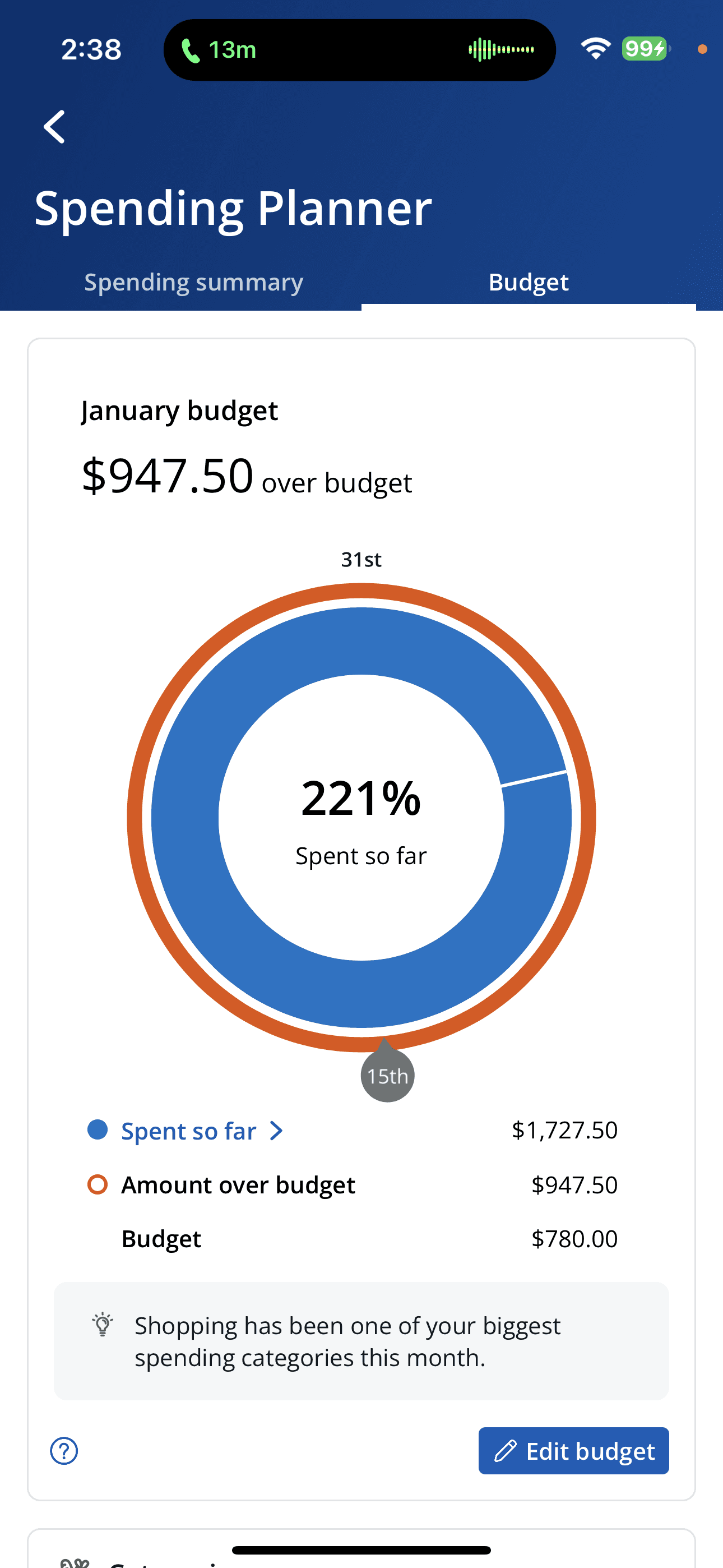

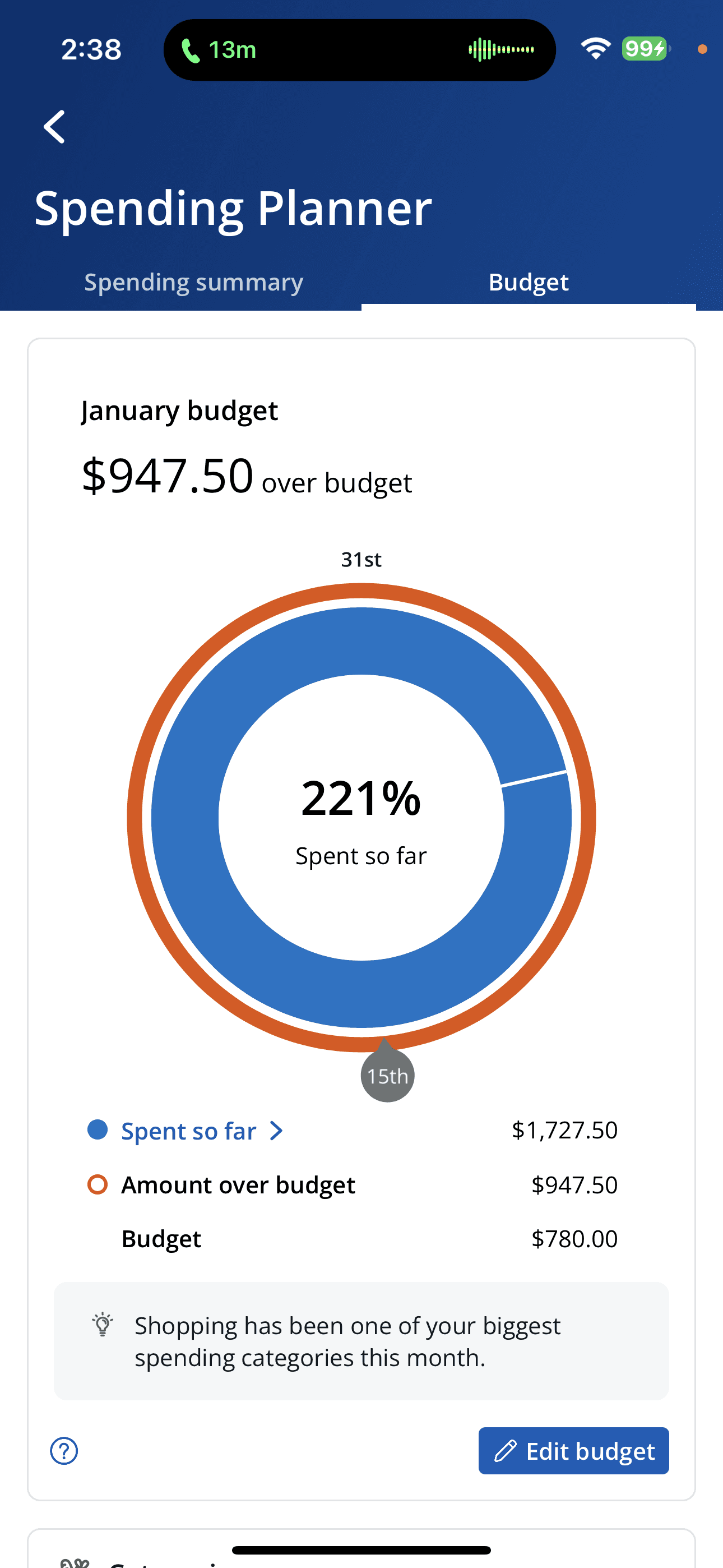

Chase Mobile App

Chase Mobile App

Typical spending and budget planners indicate over budget, but no guidance or action items are suggested to users.

Typical spending and budget planners indicate over budget, but no guidance or action items are suggested to users.

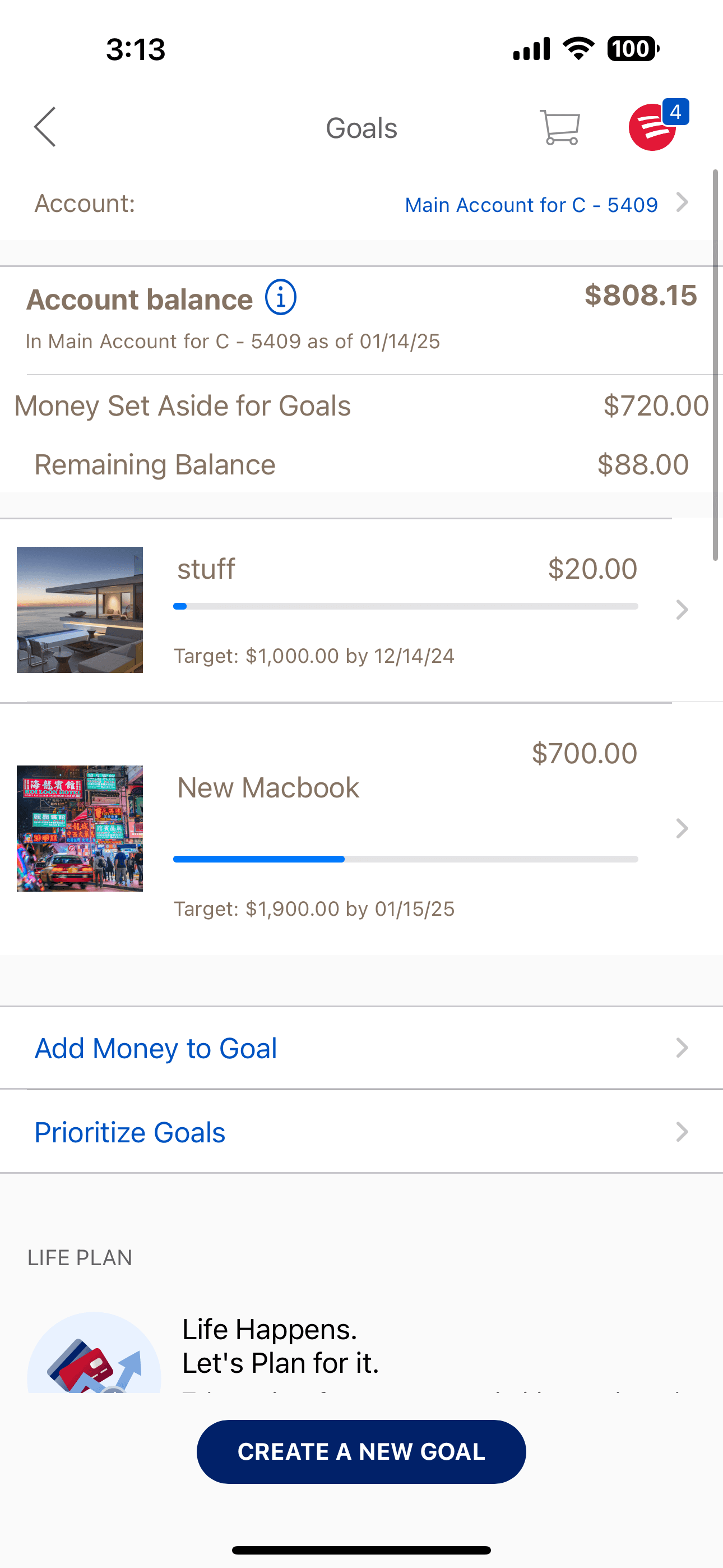

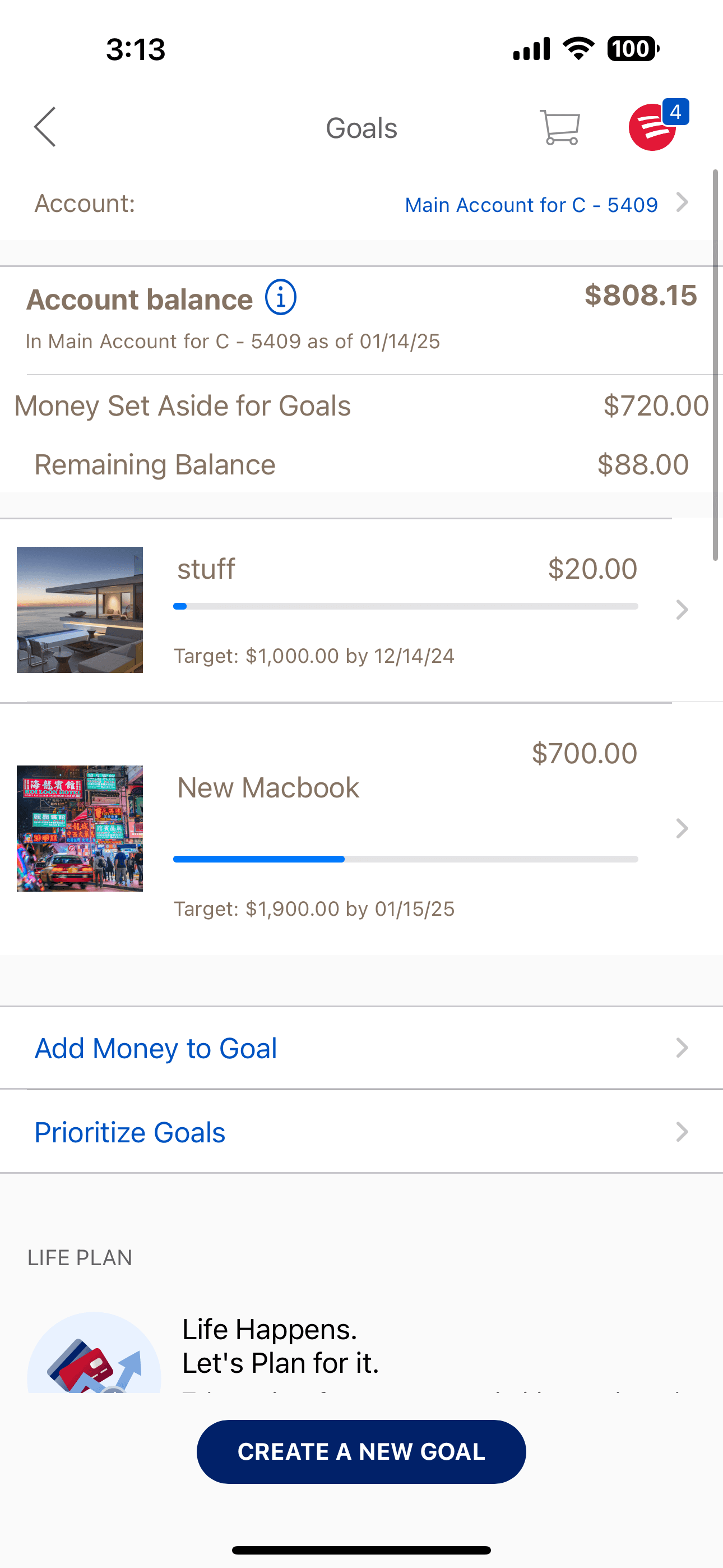

BofA Mobile App

BofA Mobile App

Static goal settings.

Goal 1 has passed target date, but no indication or assistance on getting user back on track.

Static goal settings.

Goal 1 has passed target date, but no indication or assistance on getting user back on track.

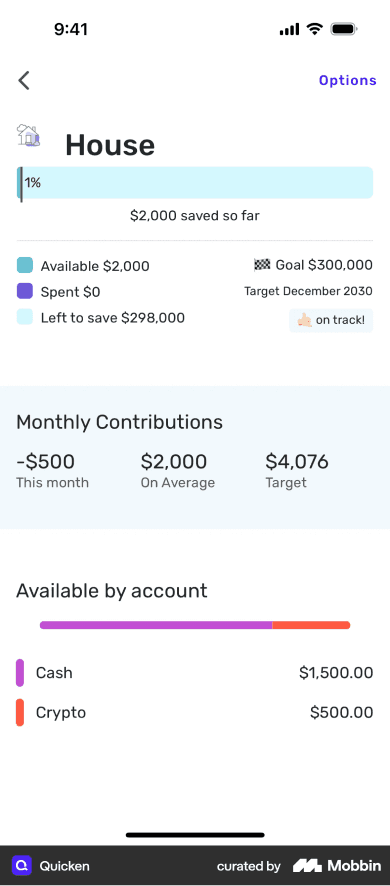

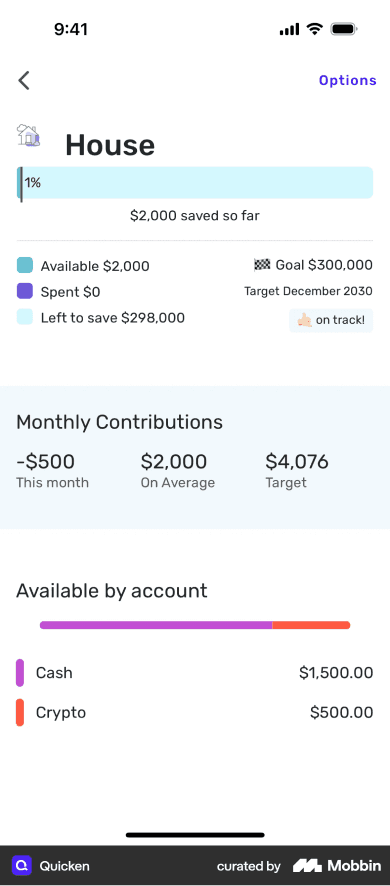

Quicken

Quicken

Manual adjustments with no automated or suggested services for users to engage with. Stagnant.

Manual adjustments with no automated or suggested services for users to engage with. Stagnant.

These insights guided the design of a solution that offers real-time feedback and AI-driven recommendations to keep users on track with their goals.

These insights guided the design of a solution that offers real-time feedback and AI-driven recommendations to keep users on track with their goals.

Design Strategy

Key features were designed to highlight the AI’s ability to dynamically adjust goals, provide real-time insights, and offer personalized recommendations for smarter financial management. My design strategy focused on three core principles below:

Key features were designed to highlight the AI’s ability to dynamically adjust goals, provide real-time insights, and offer personalized recommendations for smarter financial management. My design strategy focused on three core principles below:

Dynamic Goal Adjustments

Dynamic Goal Adjustments

Ensure the assistant could adjust financial goals in real time based on spending patterns, income changes, and emergency expenses.

Ensure the assistant could adjust financial goals in real time based on spending patterns, income changes, and emergency expenses.

Proactive Behavioral Feedback

Proactive Behavioral Feedback

Offer real-time feedback on user behavior with actionable suggestions to help them stay aligned with their goals.

Offer real-time feedback on user behavior with actionable suggestions to help them stay aligned with their goals.

Contextual Nudges

Contextual Nudges

Delivering timely, actionable prompts that encourage users to stay on track with their financial plans.

Delivering timely, actionable prompts that encourage users to stay on track with their financial plans.

Design Solution

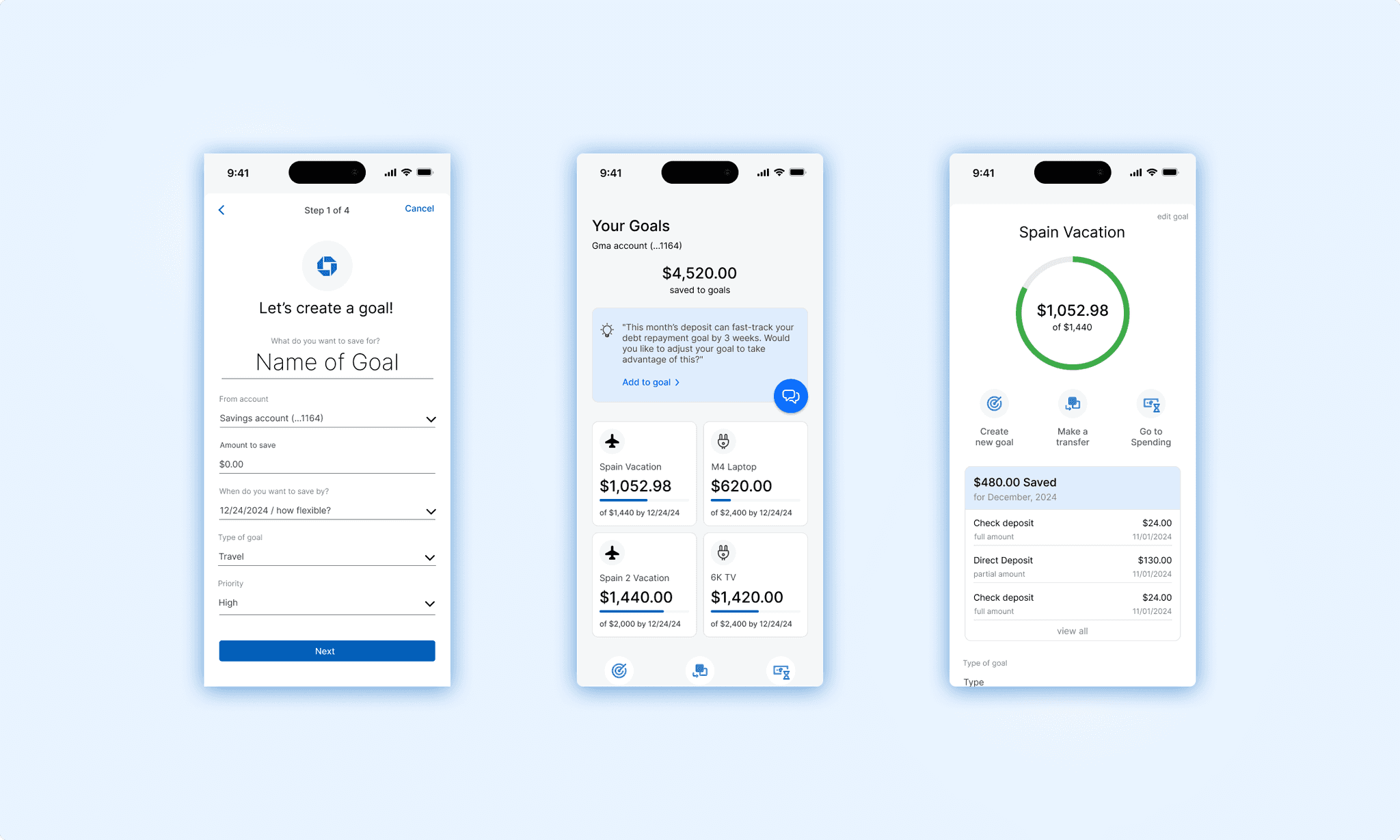

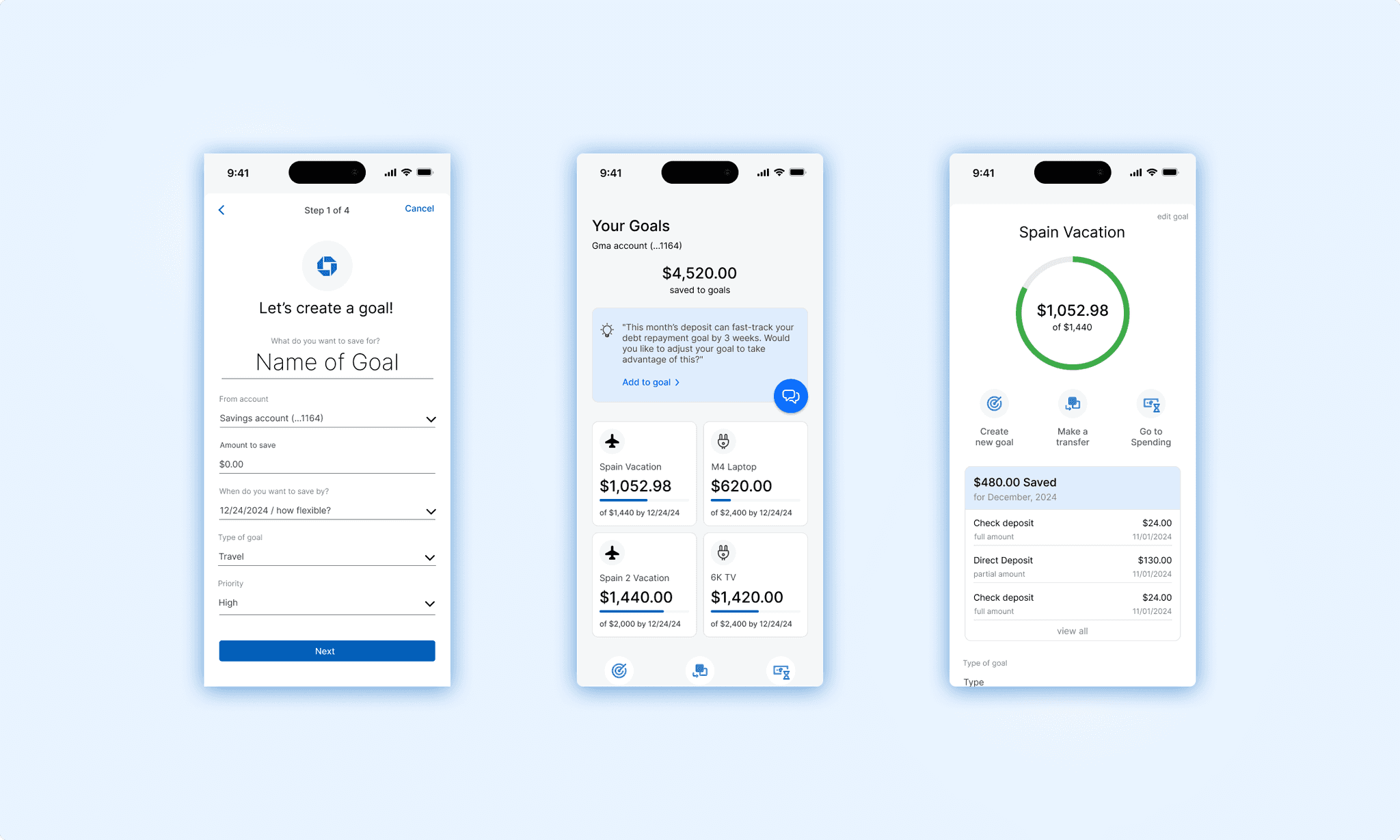

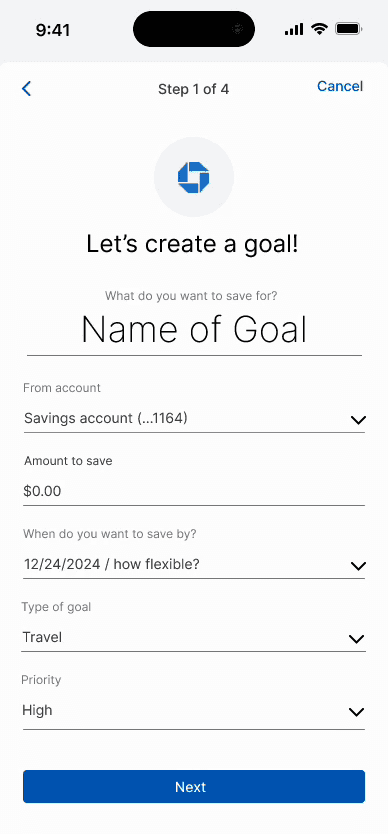

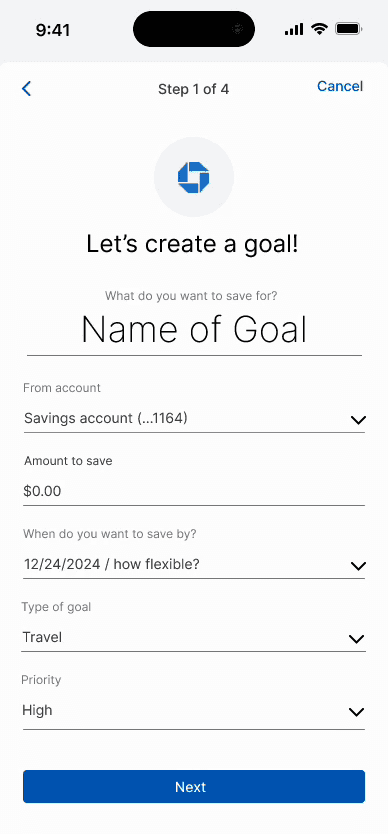

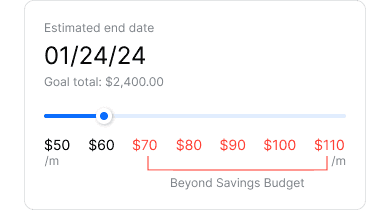

Dynamic Goal Adjustment with Predictive AI

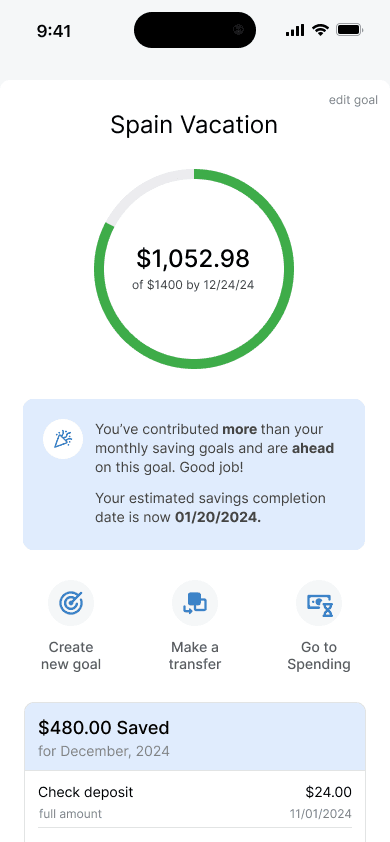

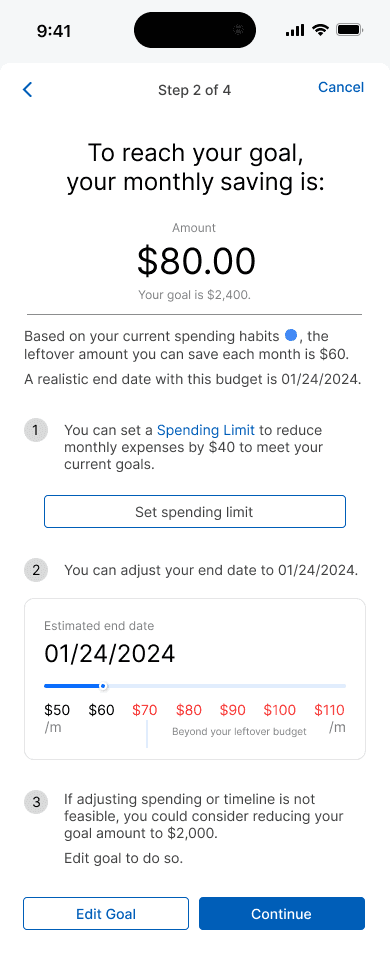

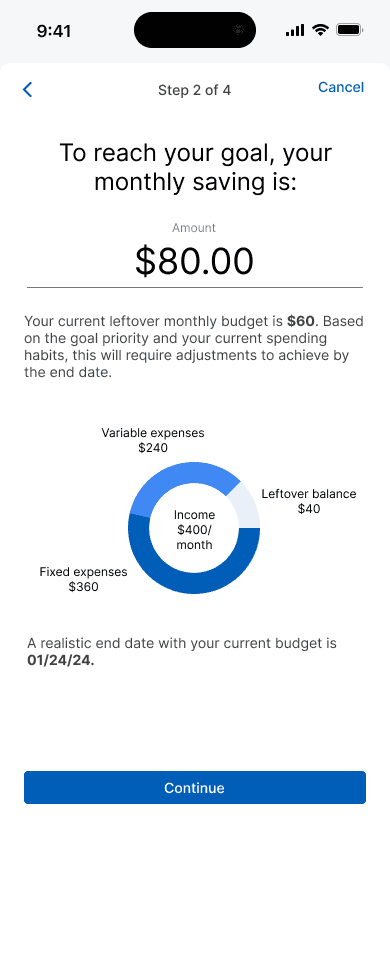

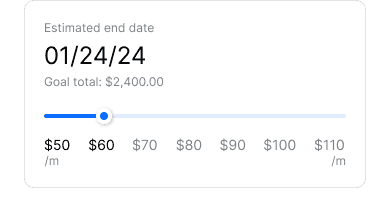

Chase assistant uses dynamic AI-driven analysis and feedback to analyze user data and offer real-time, actionable adjustments prior to setting goals.

Key Features:

Real-Time AI Insights: The assistant predicts the feasibility of financial goals based on historical spending and offers clear adjustments.

Example: "Based on your savings rate, achieving this goal will take 8 months. Increase contributions to $850/month to meet your 6-month target."

User-First Flexibility: Users can modify goals or proceed with trade-off insights, ensuring transparency and control.

Impact: By addressing potential challenges upfront, users start their financial journeys with clarity and confidence.

Chase assistant uses dynamic AI-driven analysis and feedback to analyze user data and offer real-time, actionable adjustments prior to setting goals.

Key Features:

Real-Time AI Insights: The assistant predicts the feasibility of financial goals based on historical spending and offers clear adjustments.

Example: "Based on your savings rate, achieving this goal will take 8 months. Increase contributions to $850/month to meet your 6-month target."

User-First Flexibility: Users can modify goals or proceed with trade-off insights, ensuring transparency and control.

Impact: By addressing potential challenges upfront, users start their financial journeys with clarity and confidence.

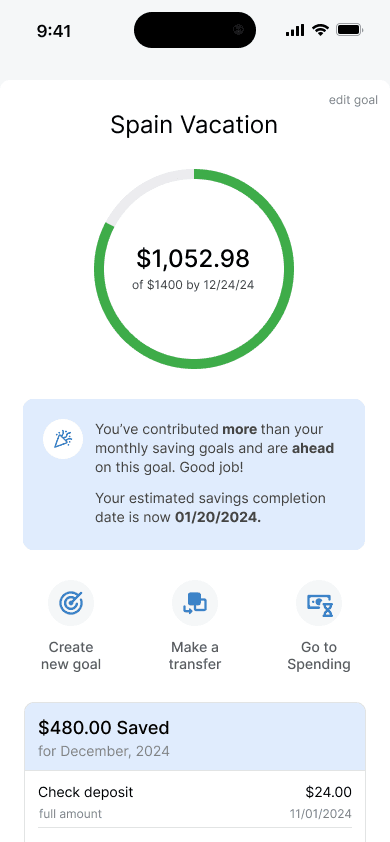

Personalized, Actionable Suggestions

Instead of generic feedback, the assistant delivers tailored advice to guide financial behavior.

Key Features:

Contextual Recommendations:

Instead of broad insights (e.g., "You spent more this month"), the AI identifies actionable steps:

Example: "Dining expenses are up by $200. Adjust your dining budget for next month to $300 to stay on track with your savings goal."

One-Click Implementation:

Users can confirm actions (e.g., budget adjustments, savings allocations) directly from the insights panel with a single click.

Impact: Streamlining actionable decisions increases user engagement and reduces financial stress.

Instead of generic feedback, the assistant delivers tailored advice to guide financial behavior.

Key Features:

Contextual Recommendations:

Instead of broad insights (e.g., "You spent more this month"), the AI identifies actionable steps:

Example: "Dining expenses are up by $200. Adjust your dining budget for next month to $300 to stay on track with your savings goal."

One-Click Implementation:

Users can confirm actions (e.g., budget adjustments, savings allocations) directly from the insights panel with a single click.

Impact: Streamlining actionable decisions increases user engagement and reduces financial stress.

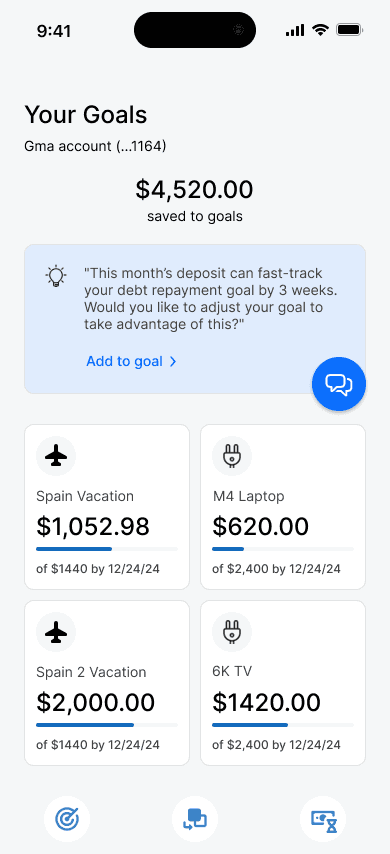

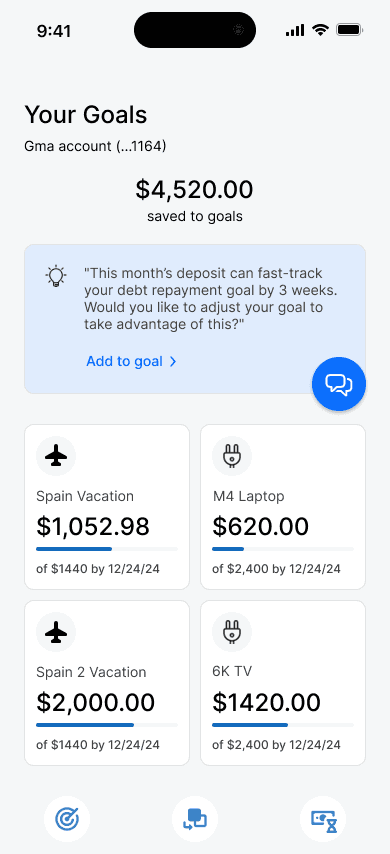

AI Nudges & On-Demand Insights

The Personalized Financial Dashboard integrates AI-powered notifications to ensure users remain proactive.

Key Features:

Proactive Nudges:

Example: "You’re $150 ahead this month. Contribute the surplus to your vacation fund to accelerate progress."

On-Demand Analysis: Users can request an AI review of their financial strategy for actionable optimization tips.

The Personalized Financial Dashboard integrates AI-powered notifications to ensure users remain proactive.

Key Features:

Proactive Nudges:

Example: "You’re $150 ahead this month. Contribute the surplus to your vacation fund to accelerate progress."

On-Demand Analysis: Users can request an AI review of their financial strategy for actionable optimization tips.

User Testing and Iteration

Before

Feedback: Users initially found goal adjustments unclear.

Feedback: Users initially found goal adjustments unclear.

After

After

Improvement: Refined language to simplify rationale and ensure notifications were concise yet actionable.

Improvement: Refined language to simplify rationale and ensure notifications were concise yet actionable.

Before

Before

Feedback: Users initially found goal adjustments unclear.

Feedback: Users initially found goal adjustments unclear.

After

After

Improvement: Refined language to simplify rationale and ensure notifications were concise yet actionable.

Improvement: Refined language to simplify rationale and ensure notifications were concise yet actionable.

Impact

The redesigned AI-powered personal finance assistant led to:

The redesigned AI-powered personal finance assistant led to:

30% increase in goal completion rates, driven by AI-powered adjustments and actionable feedback.

30% increase in goal completion rates, driven by AI-powered adjustments and actionable feedback.

40% higher engagement with goal-setting features, as users felt more confident in their ability to meet goals that dynamically adapted to their behavior.

40% higher engagement with goal-setting features, as users felt more confident in their ability to meet goals that dynamically adapted to their behavior.

85% of users reported feeling more confident in managing their finances, with many citing the personalized, real-time adjustments as the key feature that helped them stay on track.

85% of users reported feeling more confident in managing their finances, with many citing the personalized, real-time adjustments as the key feature that helped them stay on track.

Future Considerations

Simplicity & Transparency: By focusing on clear communication and simplicity, we made complex financial data accessible, empowering users to make informed decisions.

AI-Driven Personalization: This project demonstrated the power of personalized AI to offer users a proactive, adaptive experience that adapts to their unique financial behaviors, leading to better financial outcomes.

Fintech Competitiveness: In an increasingly competitive fintech industry, this solution stands out by offering a truly dynamic, AI-powered assistant that evolves with users’ needs and provides real-time, actionable insights.

Simplicity & Transparency: By focusing on clear communication and simplicity, we made complex financial data accessible, empowering users to make informed decisions.

AI-Driven Personalization: This project demonstrated the power of personalized AI to offer users a proactive, adaptive experience that adapts to their unique financial behaviors, leading to better financial outcomes.

Fintech Competitiveness: In an increasingly competitive fintech industry, this solution stands out by offering a truly dynamic, AI-powered assistant that evolves with users’ needs and provides real-time, actionable insights.

© 2024 Pamela Hsiung